HMRC has been accused of using “dangerous and sinister” new tactics in a tax crackdown that has already been linked to 10 suicides.

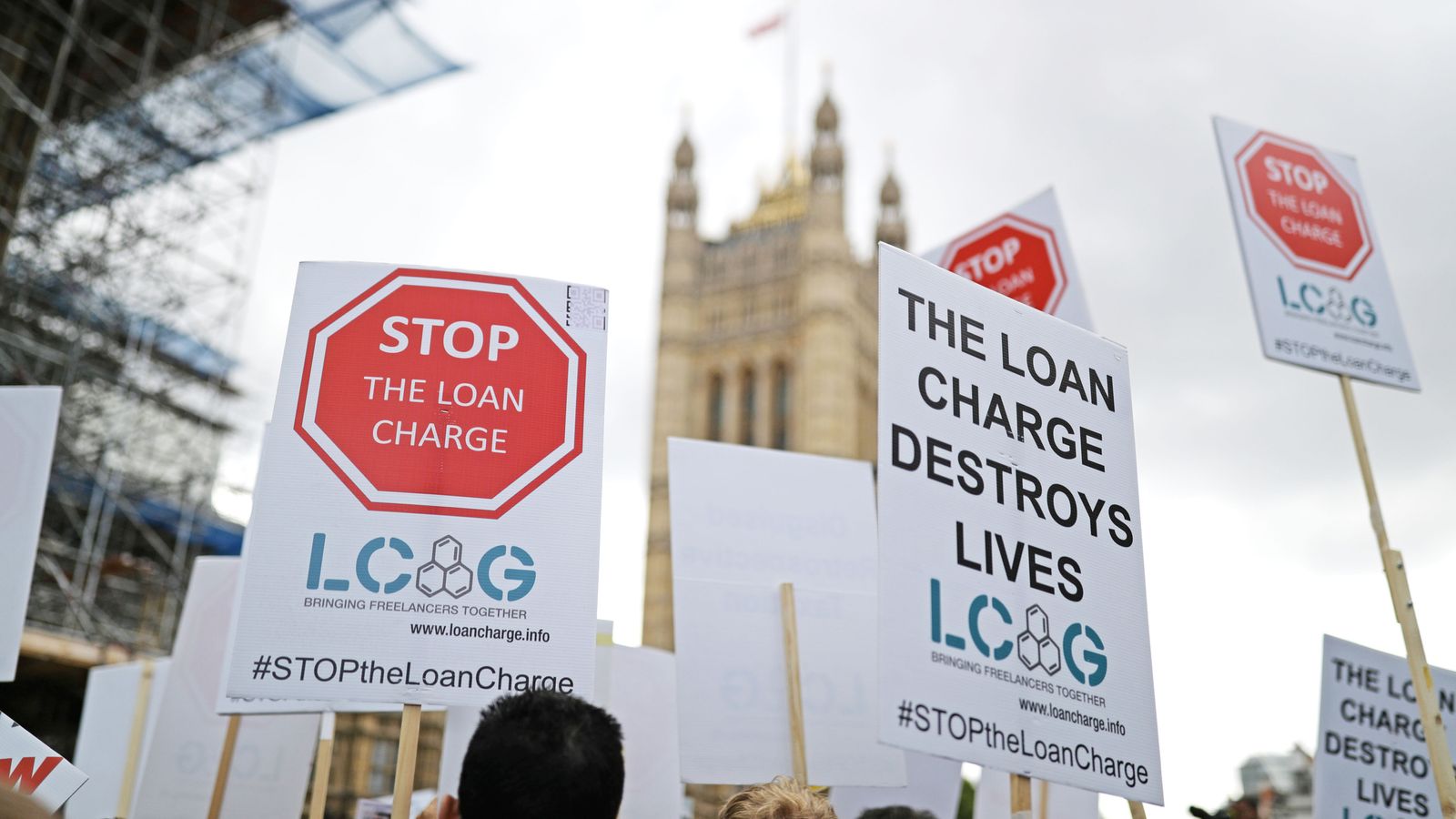

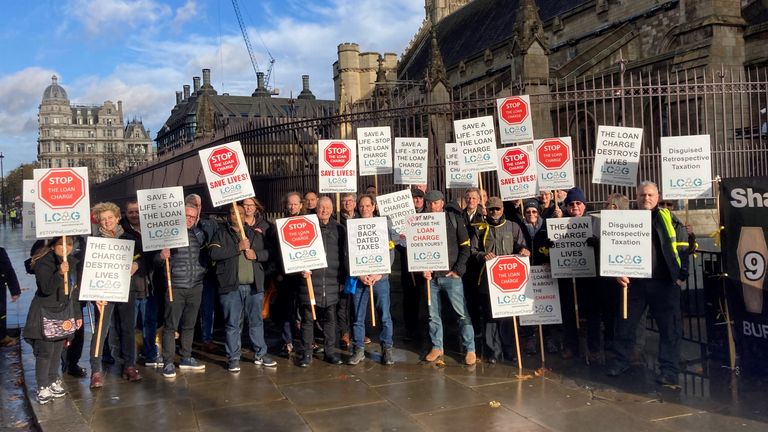

The government has recently come under pressure over the “Loan Charge” – controversial legislation which made tens of thousands of contractors who were paid their salaries through loans retrospectively liable for tax their employer should have paid.

The clampdown has been branded on par with the Post Office Horizon scandal as the unaffordable bills have been linked to suicides and bankruptcies, while one woman had an abortion due to the financial strain she was under, a debate in parliament heard last month.

HMRC has been criticised for going after individuals – including teachers, nurses and cleaners – rather than the firms that profited from promoting the schemes as tax compliant.

Politics Live: MPs return to Westminster after double by-election defeat for Sunak

However ministers have resisted pressure to overturn the policy, saying a review conducted by Lord Morse in 2019 resulted in a series of reforms to reduce the financial pressures of the some 50,000 people affected.

Crucially this included cutting the policy’s 20-year retrospective period so only loans received after December 2010 were in scope.

However it has emerged that HMRC have been pursuing people involved in loan schemes prior to 2010 through a different mechanism – a s684 notice.

This effectively gives HMRC the discretion to transfer a tax burden from an employer to an employee for the tax years excluded from the Loan Charge.

Conservative MP Greg Smith, co-chair of the Loan Charge APPG, said it “flies in the face” of what Lord Morse intended and risks more people taking their own lives because of the unaffordable bills.

‘I could lose my home’

Sky News spoke to people who said they had experienced suicidal thoughts and feared becoming homeless after unexpectedly receiving the notices.

While the s684s don’t state how much tax is owed, one father-of-three said his bill could be as high as £250,000 as this is how much HMRC have previously tried to claw back from his time in a loan scheme pre-2010.

The IT consultant, who asked to remain anonymous, said he attempted to settle his tax affairs years ago but communication with the tax office “fizzled out” and following the Morse review he believed the “nightmare” was behind him.

Then in November he received a brown envelope containing an s684 and now he is worried HMRC is “going to absolutely hammer me” just as he is approaching retirement age.

“I have three children and in the worst case scenario I will lose my home.

“I can’t think of another government policy that has caused so much suffering. I fear this could really push some people over the edge.”

‘Dreadful landscape’

It is not clear how many people have been sent the notices.

The government previously estimated that 11,000 people would be removed from the Loan Charge by introducing the 2010 cut off.

While the Loan Charge is seen as particularly punitive because it adds together all outstanding loans and taxes them in a single year, often at the 45% rate, the notices mean HMRC can use its own discretion to turn off an employer’s PAYE obligations and seek the income tax that would have been due that year from the employee instead.

Rhys Thomas, director of the WTT tax firm, told Sky News: “There is considerable and understandable confusion amongst taxpayers that when the Morse review removed the loan charge for payments pre 9th December 2010, it was assumed that HMRC had no further recourse for those years.

“Where enquiries were outstanding for the earlier tax years, HMRC will seek to conclude these by utilising tools such as s684 notices.”

He called the situation a “dreadful landscape” as those in receipt of the notices only have 30 days to respond to HMRC over something “that has taken them 15 years to investigate”.

Click to subscribe to the Sky News Daily wherever you get your podcasts

There is no right to appeal the notices, so the only way to challenge HMRC is through a costly Judicial Review.

“It’s causing a huge amount of distress and anxiety; it’s hugely concerning and for lots of people it’s come as a surprise,” Mr Thomas said.

WTT is representing around 200 people who are challenging the notices, saying HMRC has not done enough to go after the core parties who should have collected the tax at the time.

A spokesperson for HMRC said the Morse Review “recommend we use our normal powers to investigate and settle cases taken out of the Loan Charge”.

They said they had been issuing the notices since May 2022, having won a case at the Court of Appeal over their use in relation to loan schemes, “so it’s not a sudden change”.

But campaigners disputed the use of the notices as “normal” and said it is another example of HMRC “abusing its power” to go after individuals rather than the companies that ran and promoted the loan schemes.

Money latest: The countries where retirement age is 58 – and those where it’s 67

‘We were mis-sold’

These became prolific in the 2000s and saw self-employed contractors encouraged to join umbrella companies that paid them their salaries through loans which were not typically paid back.

HMRC has argued those who signed up to the schemes are tax evaders who need to pay their fair share. But those affected claim they are victims of mis-selling as the arrangements were widely marketed as legitimate by the scheme promoters and tax advisers, and in some cases they had no choice but to be paid this way.

IT consultant Daniel (not his real name), from Stoke, said he did not stand to make any money from the scheme he joined in 2008 and was simply trying to avoid falling foul of complex off-payroll rules known as IR35.

His tax adviser said the scheme was HMRC compliant and the company said they “would sort out my taxes”, he added.

He said he “did not hear a peep” from HMRC during his time in the scheme and his payslip looked normal as around 20% was being deducted from his salary each month – money experts say will have gone into the profits of those running the company rather than tax to the exchequer.

Now, he is expecting a £30,000 bill after receiving an s684 in November – cash the father-of-four “does not have”.

“If I felt like I had done something wrong I would accept it but I did not make one penny from this scheme, it was all to do with compliance and to make my life as simple as possible.

“This is causing so much stress and frustration. I have had plenty of sleepless nights.

“It feels like the Post Office scandal where we are the little people being backed into a corner and there’s nothing we can do and those who are really guilty are just laughing.”

Read More:

Post Office scandal: New concerns raised over second IT system used in branches

Buying a flat ruined my life’: Leaseholders plead for tougher legislation against home ownership ‘scam’

HMRC ‘abusing its powers’

The notices have renewed calls for the government to find a new solution to the Loan Charge scandal.

Keith Gordon, a tax barrister, said HMRC “is effectively responsible for this mess because they failed to warn employees that they did not like these schemes”.

“Most people, if they got a whiff of HMRC dislike, would have left these schemes but they were sold it as being tax compliant. Why should the blame be on people who were at the very worst merely naïve?”

Campaigners fear the s684s will be used across the board instead of the Loan Charge, which Labour has said it will review if it wins the next election.

Steve Packham, of the Loan Charge Action Group, accused HMRC of being “downright reckless” in light of the 10 confirmed suicides, adding: “This is sinister and dangerous and is another example of how out-of-control HMRC is.

“The government must immediately order a stop to these notices and instead agree to find a resolution to the Loan Charge Scandal before there are more lives ruined.”

A HMRC spokesperson said: “We appreciate there’s a human story behind every tax bill and we take the wellbeing of all taxpayers seriously.

“We recognise dealing with large tax liabilities can lead to pressure on individuals and we are committed to supporting customers who need extra help with their tax liabilities. We have made significant improvements to this service over the last few years.

“Our message to anyone who is worried about paying what they owe is: please contact us as soon as possible to talk about your options.”

Anyone feeling emotionally distressed or suicidal can call Samaritans for help on 116 123 or email jo@samaritans.org in the UK.