Hope of a meaningful drop in global oil prices have been dashed after a major group of oil-producing nations, including Russia, agreed to increase volumes by a much lower rate than requested.

The United States had called on the OPEC+ cartel to raise output by at least 300,000 barrels per day (bpd) to help ease prices.

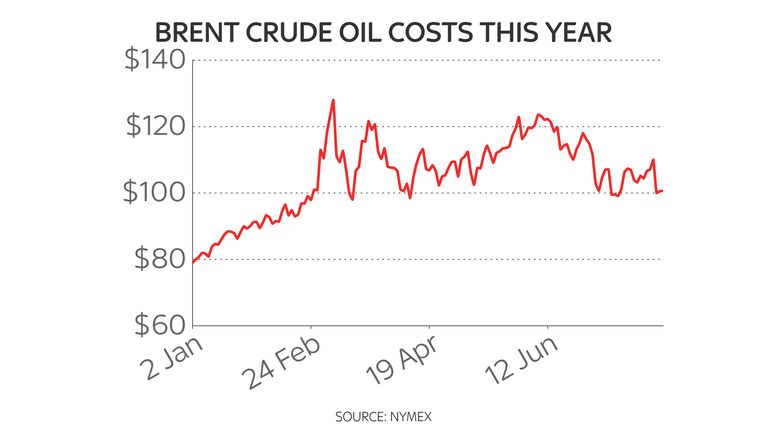

They began climbing steadily from pandemic lows as economies got back in gear following COVID restrictions but spiked in the wake of Russia’s war in Ukraine, exacerbating fears that supply could fail to meet demand.

But the cartel – which is led by Saudi Arabia – and its allied non-members said on Wednesday that they would collectively raise their oil output target by 100,000 barrels per day.

Brent crude was trading slightly up at just over $100 a barrel on the news while US crude futures slipped slightly to $94.

While the US had asked the group to boost production, spare capacity is limited and Saudi Arabia may be reluctant to

beef up output at the expense of OPEC+ partner Russia, hit by Western sanctions over the Ukraine conflict.

Ahead of the meeting, OPEC+ trimmed its forecast for the oil market surplus this year by 200,000 bpd to 800,000 bpd, according to the Reuters news agency.

Global oil prices have been among the drivers of inflation across Western economies.

While Russia is among the largest producers, it has been the reduction in its natural gas exports to Europe that have made the inflation problem more acute.

State-owned Gazprom has reduced output to just 20% of capacity in the core Nord Stream 1 pipeline, threatening to leave continental Europe with a shortage heading into the key winter season of high demand.

UK wholesale prices have also risen in sympathy because of the wider scramble to secure more stocks.