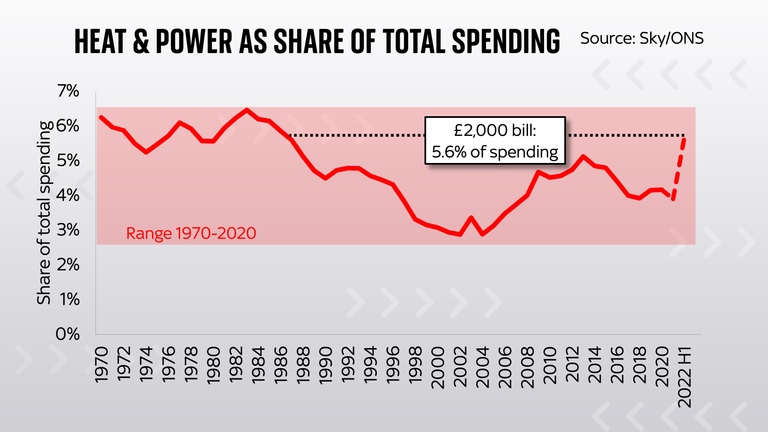

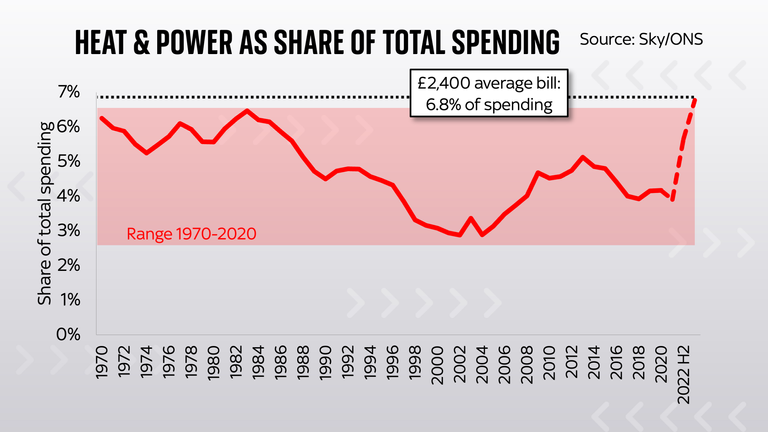

Households in Britain could soon be spending more of their money on energy than any previous generation, including during the oil shocks of the 1970s and ’80s, according to Sky News analysis.

If the energy price cap rises in line with current wholesale prices, by the end of the year the share of family expenditure on heat and power will exceed the peaks of the 1980s, taking them towards unprecedented highs.

The projections are the latest evidence of the impact families will face if and when record gas prices are passed onto them by their providers.

Together Energy latest supplier to collapse

In 2019/20, before the latest series of price hikes, Britons were on average spending 4.2% of total household spending on electricity, gas or other fuels to heat their homes. This was comfortably below the average over the past half century, about 4.7% of total spending.

However, if the energy price cap takes the average bill up to £2,000 this spring, as is implied by Ofgem’s formula, the share spent on heat and power will rise to 5.6% of spending. That would be the highest overall electricity/gas burden since the early 1980s.

If the price cap rises again in the autumn to £2,400, as is implied by current wholesale prices, that would push up spending on power and heat to 6.8% of household expenditure. This would be the highest level since at least 1970, in other words higher even than during the fuel crisis of the 1970s.

The previous peak was 6.3% of household spending in 1983.

These are aggregate numbers, so do not necessary represent the experience in specific households, some of which will face considerably higher energy burdens.

In particular, those in low income and low expenditure households may see their energy burden rise to 13% of total spending or above.

Nonetheless, the numbers, which are calculated conservatively assuming strong increases in overall household spending in line with the Office for Budget Responsibility’s nominal GDP forecasts in 2021 and 2022, underline the historic nature of the price increases.

They also highlight why the government looks set to take action to reduce the impact of these bills on households, or to spread out the cost over subsequent years.

However, with wholesale markets suggesting high prices for the next 18 months at least, there is a chance that pay-later tactic backfires, pushing up public debt, and hence debt interest payments, in the coming years.

Sky News analysis also found that nearly 40% of non-discretionary household spending on taxes, bills, mortgage interest and energy, is set to rise sharply this year, with Bank of England interest rates and payroll taxes (including the new health and social care levy) cutting further into household incomes.

The combined squeeze comes just as Britain had recovered from the longest period of falling real incomes since the Napoleonic era.